The only woman who can guarantee your financial independence, is you.

No one cares about your money more than you.

Taking control of your money starts with building financial knowledge from someone who will explain it to you in a straightforward way, without financial jargon or judgment.

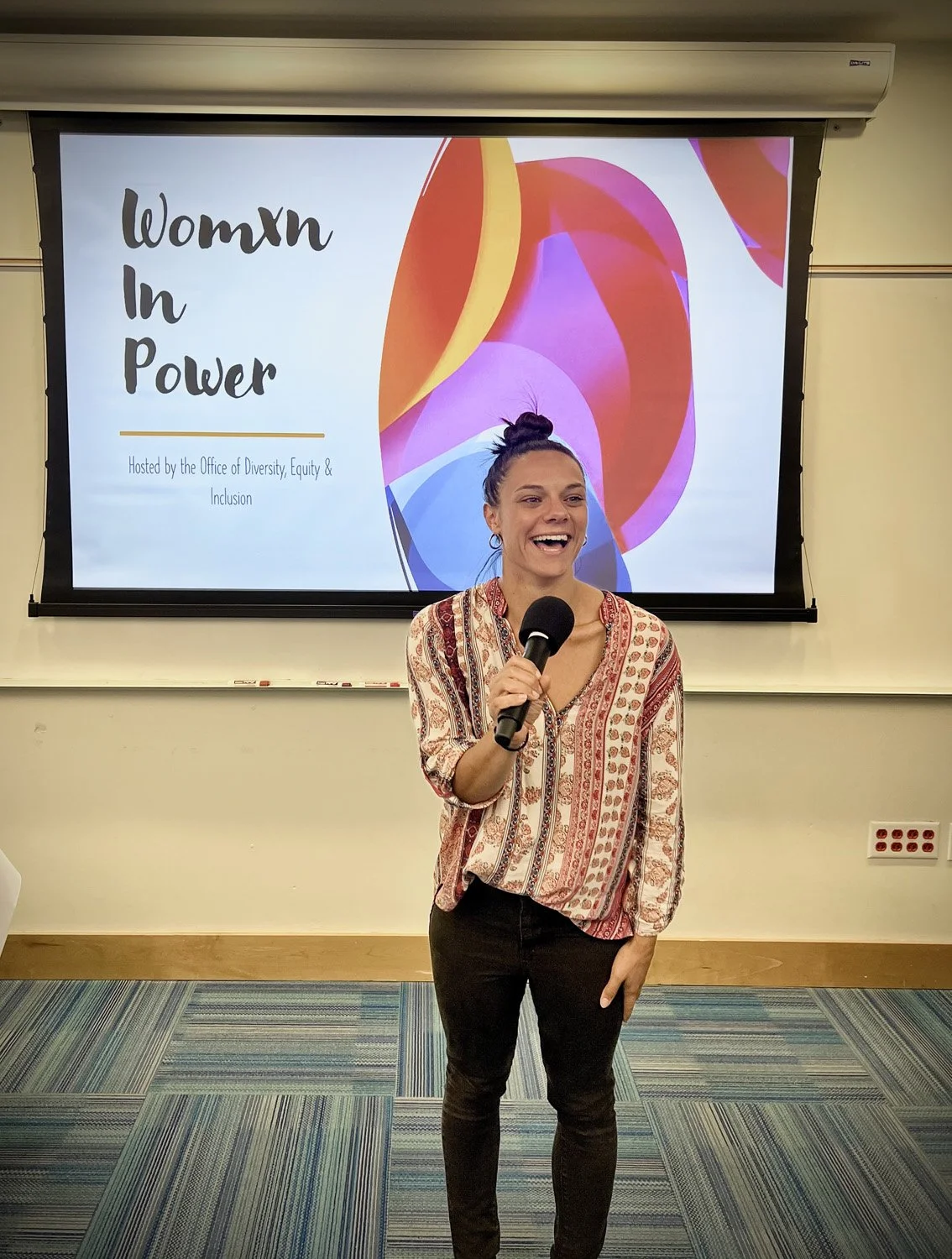

That’s where I come in.

I help women take control of their financial future by providing digestible and down-to-earth investing education.

I’m here to demystify investing, so that you can learn how to grow your money using simple investing and ultimately have more security, flexibility, and freedom in your life.

This is about more than just money—this is your future, on your terms.

The financial industry loves to gatekeep… so I do things differently.

Today I’m a serial investor, investing in the stock market, real estate, businesses, and syndications.

But I used to have no idea where to start when it came to investing.

Not believing I was smart enough to invest on my own, in my 20’s I hired a financial advisor (a fiduciary, someone legally obligated to act in my best interest). Of the several investing mistakes I made, hiring someone without getting my own investing education was the biggest one—and I lost thousands of dollars and hundreds of thousands in potential growth opportunities, leaving me with a healthy amount of financial anxiety, shame, and regret.

I want EVERY. SINGLE. WOMAN. to get a basic investing education without the bullshit gatekeeping.

After realizing what a big mistake I had made in my investing journey, I dedicated my time to learning from books, courses, financial advisors I trusted, and millionaire investors and I learned one incredible truth: effective investing doesn’t have to be complicated — and, with some basic education, it can be done by ANYONE (even if you’re totally new to investing and don’t want to spend your free time managing your investments).

Now as a Financial Educator and Serial Investor with 10+ years of investing in real estate, the stock market, and businesses under my belt, I help women take their financial power back by developing a strong money mindset and learning simple investing strategies anyone can do.

You might already know that on average, women earn just 82 cents per dollar earned by men (for black women this number drops to only 63 cents).

You might not know that there is also a gender investing gap.

When women+ have lower salaries than men, and then invest less, our proportional net worth takes a massive hit.

Only 46% of millennial women (1980 to 1995) feel confident in their investing abilities.

71% of women choose to keep their assets in cash compared to 60 percent of men.

61% of millennial women report that worry about money has caused them to be emotionally or mentally unwell.

What frustrates me more than all of those statistics, however, are articles targeted at women telling them if they saved more by spending less money on lattes and makeup that they’d be wealthier. Let’s call this what it is: gaslighting! And it’s not helping anyone. There’s a better way to wealth, and I’m here to share it with you.

I often hear people say they are “bad at money” or “afraid of doing it wrong”. But personal finance and investing are just skills that can be learned… just like yoga, needlepoint, or riding a bike.

Thoughtful investing changed my life for the better. It has given me the confidence to know that I can retire comfortably (and early), the power to make decisions independently, and the freedom to switch careers multiple times in my life.

It’s time we get more money in the hands of women.

Because wealth is not just about being rich… it’s about having security and safety (the ability to walk away from a toxic situation is priceless).

It’s about having more time to do the things we love, with the people we care most about.

It’s about freedom, flexibility, and the ability to make a larger impact.

Free Class and Q&AReady to take control of your money?

Sign up for my free beginner investing workshop designed specifically to create a safe space for women to learn how to invest in the stock market using simple strategies anyone can learn, even if you’re super short-on-time.