Ditch the mom guilt: 3 ways to rethink saving for your kid’s college

How to secure their future…and yours.

"I feel so guilty that I'm not saving yet for my kids college."

I hear this constantly and it breaks my heart.

The highlight reel of social media makes us feel like all the other perfect mom's are doing it all including saving for their kids college.

Many moms feel a pang of guilt when they think they're not saving enough for their children's college education.

If you're one of them, take a deep breath—you’re not alone.

First, it’s possible your kid might not even go to college. Enrollment at 4-year private for-profit colleges has actually decreased by about 54% between 2010-2021 while enrollment at 4-year public colleges increased by 15.1% during the same period (NCES study.)

The reality is most moms are also still trying to figure out their own finances and the pressure to save for their kids too is overwhelming.

According to the Northwestern Mutual Study 2024, 23% of parents are still trying to pay off credit card debt while trying to save for their kids' college.

Balancing personal financial obligations with the desire to provide the best for your children is challenging.

Rethinking your approach, however, can help you secure both your future and theirs.

Here are three ways to rethink how (and if) you should be saving for college:

1. Put your own mask on before assisting others (why your retirement comes first)

As a mom, it's instinctual to put your children's needs before your own. When it comes to financial planning however, securing your retirement should come first.

The fact of the matter is that your kids have more time until retirement than you do. The longer you wait to prioritize investing for retirement, the harder it will be for you to have a comfortable retirement.

This is due to compound interest. As you invest, your money grows increasingly faster overtime thanks to compound interest.

Still feel like prioritizing your own retirement is selfish?

Here's are a few good reasons why it’s not:

There are no loans for retirement: While your children can apply for scholarships, grants, and student loans to fund their education, there are no loans available to fund your retirement. While we can assume there will be some social security, it’s up to us to ensure that we can retire comfortably.

Preventing future financial burden: By ensuring you're financially independent in your later years, you reduce the likelihood of becoming a financial burden on your children down the line.

Setting an example: Demonstrating responsible financial planning teaches your kids the importance of saving and investing for their own future.

Before you start saving for your kids college, here are a few steps you should take first.

Emergency fund first: Ensure you have an emergency fund covering 3-6 months of living expenses before allocating funds to college savings.

Focus on paying off any high interest debt: Saving for your kids college while incurring more debt due to interest is like trying to run up a fast escalator. Any progress you make in the savings department can be thwarted if you’re incurring more debt or continuing to pay interest on debt. The average return of the stock market is roughly ~8%, so any debt with interest rates higher than that, should be prioritized.

Maximize your retirement contributions: Aim to contribute as much as you can to your 401(k) or IRA accounts as early as possible. This not only helps you save on taxes, but also gives your money a chance to grow over time.

2. Empower yourself and your family with basic financial and investing education

Knowledge is power, especially when it comes to money. By learning the basics of investing, you not only improve your financial situation but also equip yourself to teach your children valuable money management skills.

If you take one thing away from this article:

If you don’t invest a single dime for your kids and instead teach them how to save and invest a bit of money each month, you will be giving them a far greater gift than any amount you could likely save for college.

Here’s an example:

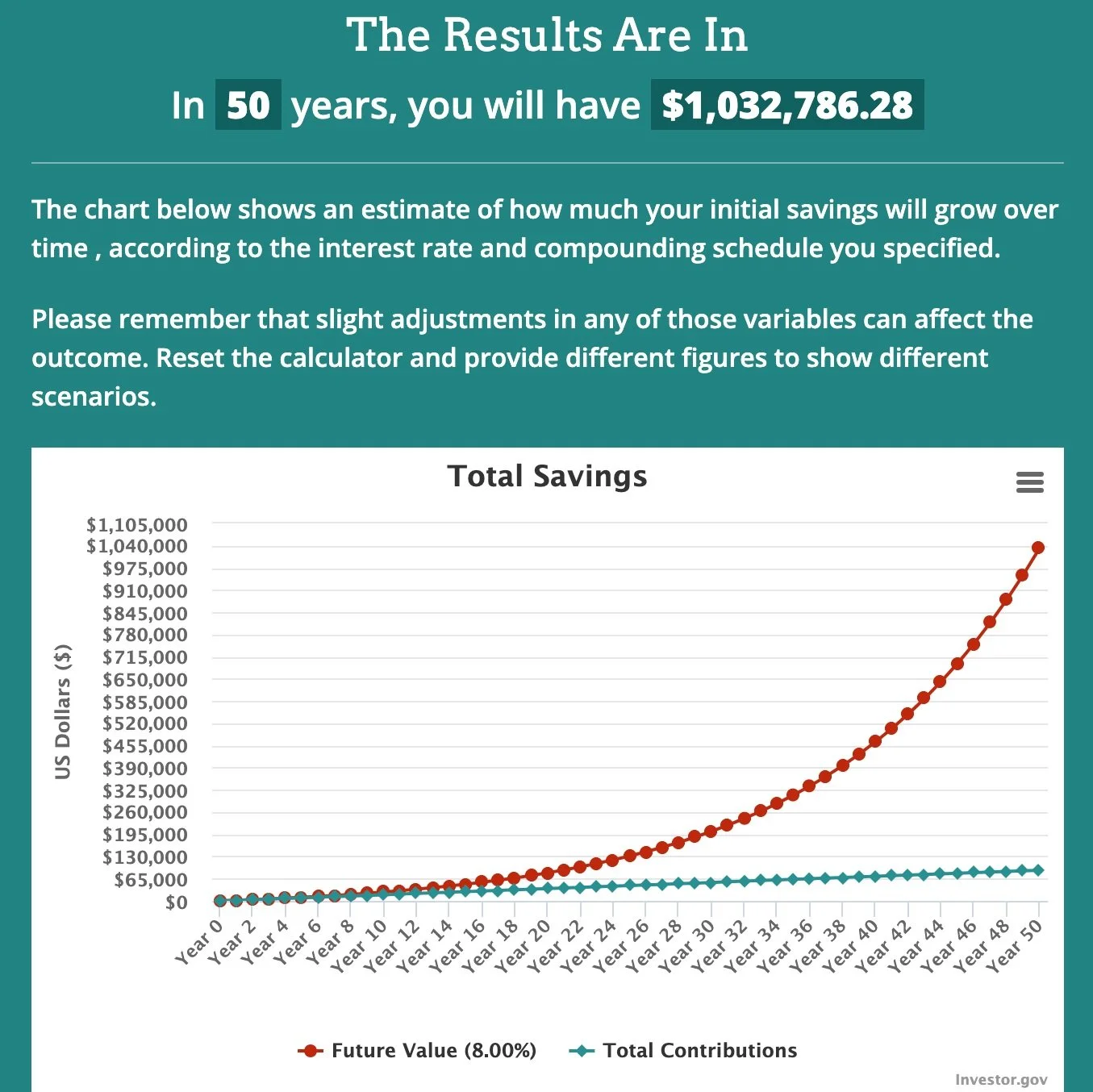

You teach your kids the value of investing and at 18 they start taking $150 of their [babysitting, sandwich making, lifeguarding] money and put it into a Roth IRA.

They continue to ONLY invest $150 for the next 50 years.

By retirement? They could have well over 1 million in tax-free retirement money, based on the average return* of the stock market.

*This math uses ~8% average return of the stock market. Past performance doesn’t guarantee future returns.

When I suggest that you get an investing education, I’m not taking about going back to school and getting a PHD in economics. I’m talking about taking ONE class, course, or reading a book on investing 101.

If you don’t understand the basics of investing, not only can you not teach your kids but you won’t be able to take full advantage of investing vehicles specifically designed to help save for your kids college expenses.

For example, the popular 529 account is an investing account that helps you save on taxes and pay for future educational expenses but can cost a lot in fees if you don’t know your options.

Here are a few other reasons learning the basics of investing can help you support your kids

Boost Your Confidence: Understanding investment concepts can help you make informed decisions that grow your own wealth more effectively than traditional savings methods.

Teach Your Kids Early: Financial literacy is a gift that keeps on giving. Educate your children about saving, budgeting, and investing to set them up for lifelong financial success. Think it’s too early to teach them? Think again. By age 3 your kids can grasp basic money concepts and by 7, they’ve already developed some money habits.

Action Steps:

You’re busy mom. You don’t have to learn everything there is to know about investing. I like to tell mom’s that learning investing basics is like learning how to drive a car. Once you learn the basics you’ll have it for life. You’re not learning enough to be a mechanic, just enough to take the right turns and understand basic traffic signs.

Take a Course: Enroll in online classes or workshops focused on beginner investing and personal finance.

Family Finance Nights: Set aside time each month to discuss money topics with your kids, adjusting the complexity based on their age.

3. Saving is great. Investing is better.

If you’ve already checked the boxes you need to check for yourself, then savings for your kids college is a wonderful privilege.

Keeping your children's college savings in a regular savings account may seem safe, but it's not the most effective strategy. If you have more than a couple years until your kid goes to college, putting money in savings account (even a high yield savings account) will at best, barely outpace inflation.

Making that money work for you through investing is a way your kid can have even more in college.

Action Steps:

Explore 529 College Savings Plans: These state-sponsored investment accounts offer tax advantages and are specifically designed for education expenses.

Consider Custodial Accounts (UGMA/UTMA): These accounts allow you to invest in stocks, bonds, and mutual funds on behalf of your child, potentially yielding higher returns.

Remember, taking care of your financial well-being is not selfish—it's one of the most responsible decisions you can make for yourself and your children. By doing so, you're ensuring that you're not only present for them today but also not a financial burden tomorrow.

By prioritizing your retirement savings, investing in your financial education, and choosing smarter investment vehicles for college funds, you'll be making empowered decisions that benefit the whole family.

Ready to take control of your financial future? Start learning the basics today and set your family on the path to long-term security and success.