You’ll lose money if you make any of these 3 common investing mistakes

Investing—the thing we know we should be doing but often feel totally unprepared for.

Maybe you’ve been putting it off because it feels overwhelming, you don’t have time to start, or you’re worried about making a mistake and losing money.

Here’s the truth: you don’t need a ton of money, an expensive financial advisor, or hours of free time to grow your wealth.

What you do need is clarity, confidence, and a simple plan to get started.

That’s exactly why I created (and am now upgrading, so stay tuned!) Money Confident—a 4-week program designed to teach you how to invest without the overwhelm, the jargon, or the stress.

Let’s break down the 3 biggest investing mistakes people make—and how you can avoid them.

The #1 mistake I see women make in investing? Waiting too long — to invest cash, to make sure your money is growing like it should if you’re already investing and not managing it yourself, or to get started at all.

The biggest myth about investing is that it takes a lot of time to learn.

The reality is that you don’t need an economics PHD to learn the basics of getting your money growing for you.

What you do need is some clear, step-by-step and jargon free education that helps you take control of your existing accounts and start investing more as soon as possible.

Because the magic of investing lies in compound interest.

💡 Imagine this:

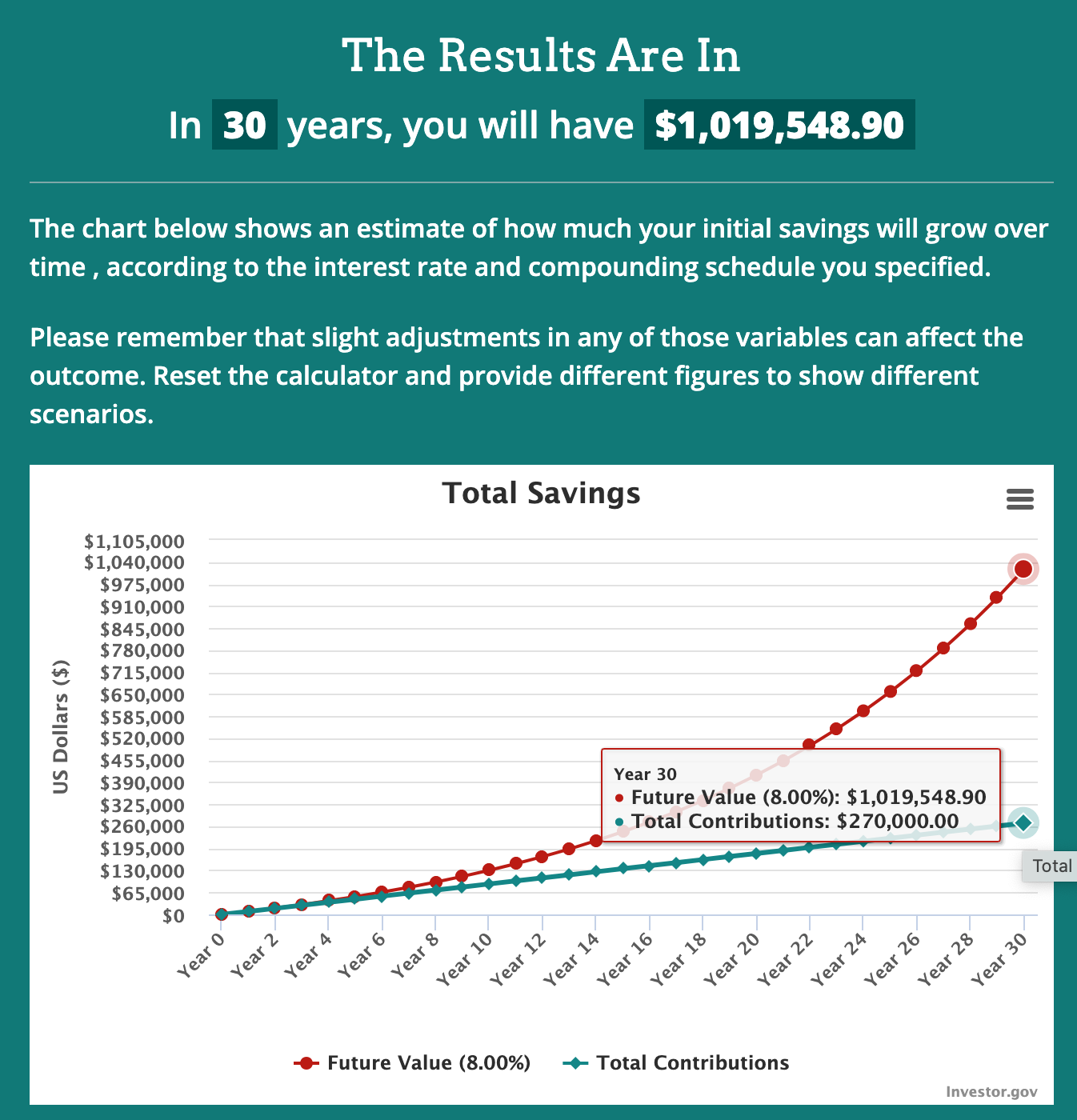

Investing $24 a week (that’s less than a couple of lattes) at an 8% return grows to an extra $168,000 in your pocket even though you only contributed ~37,000.

That means you earn ~$130,000 of completely passive income.

👈 Bump that up to investing $750 a month, and you’re looking at over $1 million over a 30 year period, even though you only contributed ~$270,000.

That’s over $700,000 of passive income thanks to compound interest at a rate of 8% (the average return of the stock market.

Waiting for the “perfect time” is a costly mistake. The best time to invest was 10 years ago. The second-best time? Right now.

Mistake #2: Overcomplicating Your Strategy

You don’t need to “beat the market” or spend your days glued to stock charts to grow your money in the stock market.

The most effective strategy for most people is actually super simple:

Learn how to buy and hold 1 to 3 index funds that hold thousands of stocks or bonds inside them already.

Contribute consistently

Save on taxes using retirement accounts

Day trading, chasing trends, or constantly tweaking your portfolio not only adds stress but often leads to losses.

Not only that, professionals are hardly able to consistently beat the market either so paying someone else to help you make more than the average return of the stock market is usually a losing battle.

Read the full article on Motley Fool here.

The type of investing I teach takes hours and weeks not months or years.

Even better, once you learn the basics, you can set up an automatic contribution right into your investing account that automatically invests in the simple funds of your choice!

In the Money Confident Academy, I teach women exactly how to set up a simple, low-maintenance portfolio that grows your wealth in less than a few weeks.

Mistake #3: Paying Too Much in Fees

Here’s a fact that blew my mind: paying just 1-2% in fees can cost you hundreds of thousands of dollars over time.

I figured this out the hard way myself.

In my 20’s, I saved up every penny I could and was lucky enough to work on a cruise ship that paid for my food, rent, and a salary.

It was a dream come true financially.

By my mid 20’s I had saved every penny and had quite a bit to invest. I was super nervous about investing in the stock market so I started by splitting my money between the stock market and by investing in a small single family home in Tampa.

I gave the money I allocated for stock market investing to a financially advisor to manage because I thought for sure that I wasn’t smart enough and didn’t have the time to do it myself.

After reading just a few investing books, I eventually learned just how much fees can impact your investing.

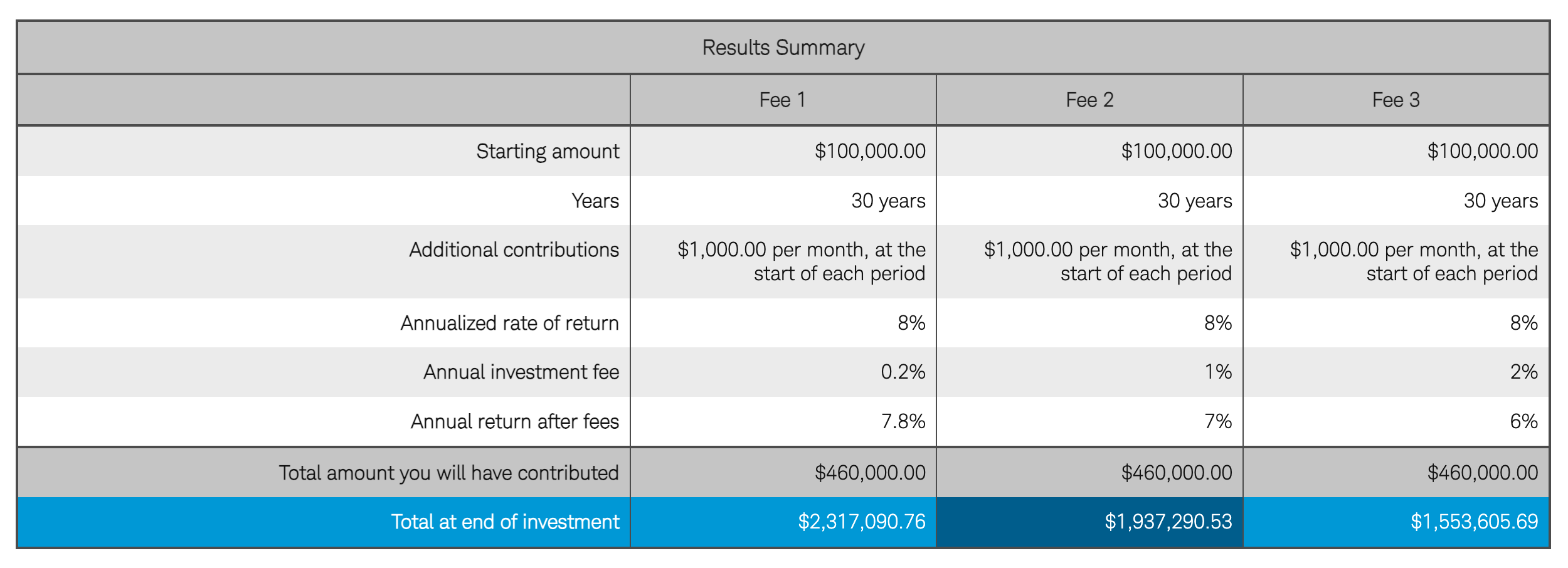

I had well over $100,000 invested with this financial advisor and figured out that I was paying over 2% in fees in some cases.

So I did the math with an online calculator and here’s what I found:

If I kept paying 2% in fees I would end up paying close to $700,000 in fees over a 30 year period!

Check out the calculator below. The column on the right shows that if I kept $100,000 invested with that advisor and added to my account over time, I’d have roughly ~$1.5M based on the pace on was on at the time.

If I learned to do it myself and saved the almost 2% in fees?

I would have ~$2.3M in retirement.

That’s a HUGE difference.

Fees are no joke.

https://www.schwabmoneywise.com/investment-fees-calculator

The good news is that not only are you capable of learning the basics of investing yourself so you don’t have to pay someone a percentage of every single dollar, but there are also amazing flat fee financial advisors that charge hourly or by project if you need help in the future.

Learning the basics for yourself not only helps you save money but also helps you vet and find the right professionals that can help you in the future.

You can learn how to pick a few simple, diversified funds in weeks.

Imagine this:

You know exactly where and how to invest your money.

You’ve built a portfolio that grows automatically with minimal effort.

You feel confident, empowered, and on track to reach your financial goals.

This is what Money Confident has done for over 200+ students over the last 2 years.

But now, it’s getting an upgrade.

I’m taking everything I’ve learned from you, all of your questions, your roadblocks and given the program a huge upgrade for 2025.

I’ve never been more excited to launch an online program because I already know it delivers…and now it’s even better.

Here’s what you’ll learn:

How to start investing even if you are completely new to investing and have zero time to waste.

The secrets to building a simple, low-cost portfolio.

How to save on taxes, maximize your returns, and minimize fees.

And how to manage your investments in less than 15 minutes a month (and in some cases completely on auto-pilot).

Join the Waitlist Today!

Enrollment for Money Confident Academy 2025 opens soon, and spots are limited.

By joining the waitlist, you’ll be the first to know when doors open—and you’ll unlock exclusive bonuses and discounts to help you get started.

This is your chance to finally take control of your finances, build wealth, and take control of your future on your terms.

Don’t let another year pass you by. The best time to invest in your future is today. Let’s make 2025 the year you become money confident.